Ling U

Ling U

Ling U

Ling U

Ling U

Ling U

Ling U

Ling U

Ling U

Ling U

Ling U

Ling U

Ling U

Ling U

Ling U

Ling U

Ling U

Ling U

Ling U

Ling U

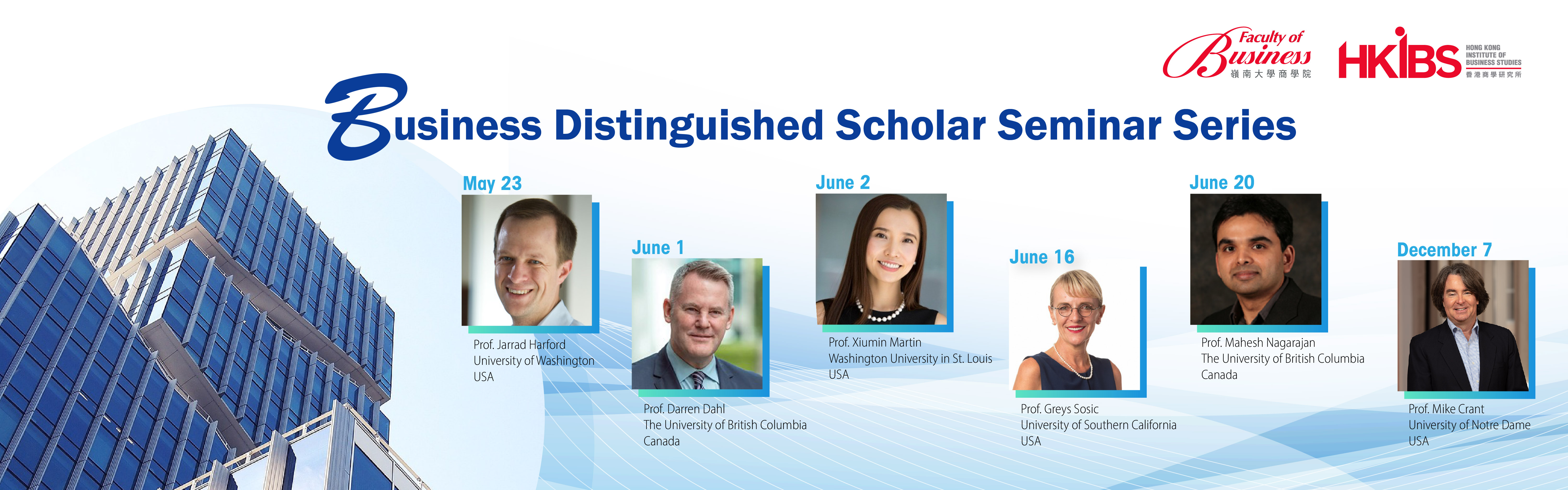

7 December 2023 (Thursday) 2:30pm (venue: SEK108, Simon and Eleanor Kwok Building, Lingnan University)

My Journey as a Professor: a Memoir

Professor Mike Crant has had a long career as a faculty member at the University of Notre Dame in the United States, and more recently as a Business Distinguished Scholar at Lingnan University. In this presentation, he will reflect on the personal and professional experiences that shaped his scholarship and academic career. Professor Crant will discuss how some critical life events led him to get a Ph.D. in organizational behavior, his choice of jobs, and the role that Lingnan University colleagues and the Department of Management have played in his scholarship and career progression. He will provide a brief autobiography and a general overview of his research, describe changes he has observed in his field of organizational behavior, and offer his future plans for continued productivity. The talk will be more of a memoir than a typical academic paper.

Ling U

Ling U

Ling U

Ling U

Ling U

20 June 2023 (Tuesday) 9:30am via Zoom (LINK) [POSTPONED UNTIL FURTHER NOTICE]

Dynamic Assignment Problem: Hardness Results, Approximability and Algorithms with Applications

Inspired by an application that involves matching sets of care providers with high risk patients, we formulate a variant of the generalized assignment problem (GAP) to model this matching. We refer to as the dynamic assignment problem. In general, it is known that the GAP of this variant is APX-HARD. For specific and useful cases of the problem, such as the one in question we present the first set hardness results. We then show “easy” to use approximation schemes with a constant guarantee that performs very well in practical settings. Inspired by these schemes, we propose a very practical heuristic whose empirical performance on matching caregivers gives near optimal performance.

Ling U

Ling U

Ling U

Ling U

Ling U

16 June 2023 (Friday) 9:30am via Zoom (LINK)

Manufacturer’s Intervention into Secondary Market: Implications

for Firm’s Pricing, Refurbishing Quality, Profit and Consumer

We utilize an analytical model to study the manufacturer's trade-in programs in markets with refurbished products. We consider three options: no intervention from the manufacturer (consumers can trade used products among themselves), partial intervention from the manufacturer (consumers can trade used products among themselves or sell them to the manufacturer, who may refurbish them and sell to consumers), or full intervention from the manufacturer (all consumers choose to trade in with the manufacturer, consumers do not trade among themselves). We focus on the firm’s two operational levers, decisions on pricing and quality of refurbishing, and show that for most products it is optimal for the manufacturer to partially intervene into the secondary market. We illustrate our results using some real-life examples.

Ling U

Ling U

Ling U

Ling U

Ling U

2 June 2023 (Friday) 10:00am (venue: SEK 106, Simon and Eleanor Kwok Building, Lingnan University)

Investor Base Disclosure and Entrepreneurial Success: Evidence from Crowdfunding

We employ a sharp regression discontinuity design to identify the causal effects of investor base disclosure on funding success and post-funding outcomes. Starting from February 2016, Kickstarter discloses backer statistics including geographic locations and previous funding experience of the backers once the number of backers for a project reaches 10. We use this discontinuity to show that the disclosure of investor base information increases the likelihood of funding success by 10% and the amount of funds pledged (relative to the stated goal) by 13%. The disclosure effect is more pronounced for projects that disclose a more experienced and geographically diverse investor base, consistent with disclosure mitigating information frictions and the incentive misalignments between creators and backers. We also find that the investor base disclosure increases the frequency of backer comments and product updates, and ultimately enhances the likelihood of product delivery.

Ling U

Ling U

Ling U

Ling U

Ling U

1 June 2023 (Thursday) 10:00am via ZOOM (Link)

Why Horizontal Organizations Don’t Fall Flat: Organizational Structure Shapes Perceptions of Company Warmth

Recent years have seen a growing number of companies evolving toward horizontal or “flat” management structures with minimal hierarchical layers of management. Some even leverage their flatness as a key marketing message and defining element of corporate identity. Although organizational structure has been researched extensively in the context of a variety of disciplines, it has remained largely absent from consumer research literature. This research investigates organizational structure through the lens of the consumer, revealing that a company’s organizational structure can shape consumer perceptions of and subsequent responses to the company. Specifically, organizational flatness (vs. tallness) enhances positive consumer reactions to the company (i.e., attitudes, online engagement, purchase intentions). This effect is driven by perceptions of company warmth, but not competence. Moreover, we highlight theoretically-relevant moderators by showing that the effect is most pronounced when the organization’s baseline levels of warmth are relatively low—that is, when the organization is a for-profit (vs. nonprofit) or when it is a large (vs. small) company. This work enriches our understanding of how a company’s organizational attributes, which are usually seen as outside the consumer’s purview may shape consumer perceptions of the company, offering insights for businesses as they embrace new ways of communicating and promoting themselves to consumers.

Ling U

Ling U

Ling U

Ling U

Ling U

23 May 2023 (Tuesday) 10:30am (venue: SEK 205, Simon and Eleanor Kwok Building, Lingnan University)

The Innovation Arms Race

Economists have long recognized that competition and innovation interact as key drivers of economic growth (Schumpeter, 1943; Arrow, 1962; Aghion and Howitt, 1992). Acknowledging this, regulators carefully scrutinize competitive behaviors that potentially affect innovation incentives, in particular in the case of proposed mergers (Shapiro, 2012). Do acquisitions of innovative targets spur or stifle innovation? To address this question, we provide a first large-scale empirical investigation of M&A effects on acquirer rivals’ incentives to innovate, and the equilibrium outcome resulting from this competitive process. Our results are consistent with an innovation arms race: acquisitions of innovative targets push acquirer rivals to invest more in innovation, both internally through research and development (R&D) and externally through acquisition of innovative targets, and this increase in innovation investment necessary to maintain competitive position leads to a decrease in firm market valuation. These results are robust to endogeneity and are driven by the high-tech sector. Markov-switching regression-based identification of arms race periods at the industry level brings additional insights into industry features conducive to innovation arms races. Patents and patent citations-based evidence shows no sign of innovation investment efficiency decline, suggesting that innovation arms races generate a transfer of economic rents to consumers. Additionally, cumulative abnormal returns and offer premium analyses indicate that target shareholders benefit from this increased competition between acquirers.

.jpg)