Ling U

Ling U

Ling U

Ling U

Ling U

Ling U

Ling U

Ling U

Ling U

Ling U

Hong Kong – Chinese Mainland Economic Integration Index (1990-2019) and Cointegration Analyses of Socio-economic Indicators

香港與中國內地經濟融合指數(1990-2019)及社會經濟指標的協整分析

Geng Cui and Yu-ho Chung

Acknowledgement: This research project was funded by the Policy Innovation & Coordination Office of the HKSAR Government (2016.A3.009.17A) and Lingnan University, Hong Kong (KT21A7).

Access Full Report

Hong Kong Institute of Business Studies (HKIBS) of Lingnan University, Hong Kong (LU) proudly introduces the Hong Kong – Chinese Mainland Economic Integration Index (1990-2019) and shares its results and in-depth analyses with the public and the community of policy makers and researchers. The full report is forthcoming in Asia Pacific Business Review, a special issue on Hong Kong, 2022.

Overview

Hong Kong and mainland China have undergone continuous economic integration over the last four decades. However, a comprehensive and scientific index for measuring the complicated structure of the economic integration between Hong Kong and the mainland does not exist. Without a precise measure of this integration, it is difficult to evaluate its economic and social outcomes or to facilitate policy debates on the acute problems facing the territory and this vital relationship.

Drawing from the literature on economic integration, we use archival data from various sources between 1990 and 2019 to construct a comprehensive index of economic integration between Hong Kong and Chinese mainland, consisting of 21 time series data along three dimensions: driving forces, throughput process, and outcome convergence. The results indicate that the two economies have become highly integrated and interdependent over time. Cointegration analyses of the long-run relationships between the integration index and other economic and social indicators suggest that such integration is in tandem with the economic development of Hong Kong (e.g., GDP growth, unemployment and property prices).

Meanwhile, the index is also associated with increasing income disparity, lack of satisfaction with the government and confidence in the future of Hong Kong, and the identity of Hongkongers. The findings reveal the positive effect of economic integration as well as deep-rooted problems in the territory. These issues present significant challenges for economic development and governance under the ‘one country, two systems’ and call for policy discourse on effective solutions.

過去四十年來,香港與中國內地經濟不斷融合。然而,一個全面、科學地衡量香港與內地經濟融合的複雜結構的指標並不存在。如果沒有這種精確衡量,就很難評估其對香港經濟和社會的影響,也很難促進有關該香港面臨的尖銳問題和這一重要關係的政策辯論。我們借鑒經濟融合文獻,採用不同來源的檔案資料(1990-2019),構建了香港與中國內地經濟一體化的綜合指數。結果表明,隨著時間的推移,這兩個經濟體已經變得高度融合並相互依存。綜合指數與香港經濟和社會指標之間的長期關係的協整檢驗表明,這種融合在很大程度上與香港的經濟發展(如國內生產總值增長、失業率和房地產價格)同步。然而,該指數也與日益擴大的貧富差距、對政府和香港未來缺乏信心以及香港人的身份認同有關。調查結果揭示了經濟融合的積極影響以及本港一系列根深蒂固的問題。這些問題對“一國兩制”政策下的經濟發展和治理提出了重大挑戰,需就有效解決方案進行政策探討。

Research Framework

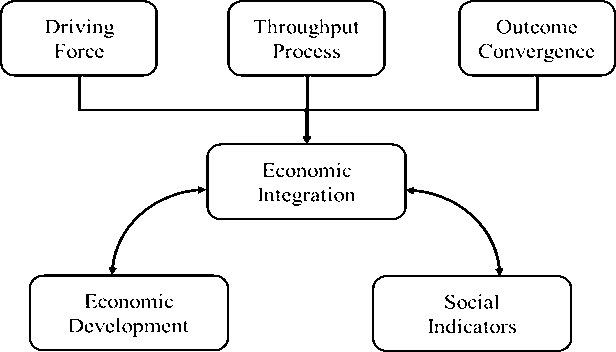

Drawing from the literature and indices of economic integration from other areas of the world (e.g., EU and NAFTA), we consider the unique characteristics of the HK-mainland economic relationship, particularly its high degree of complementarity and asymmetry, in defining and measuring economic integration to assess the extent of such integration and its effect on socio-economic development in Hong Kong. The index includes three dimensions: driving forces, throughput process, and outcome convergence (Figure 1).

Indicators of Economic Integration

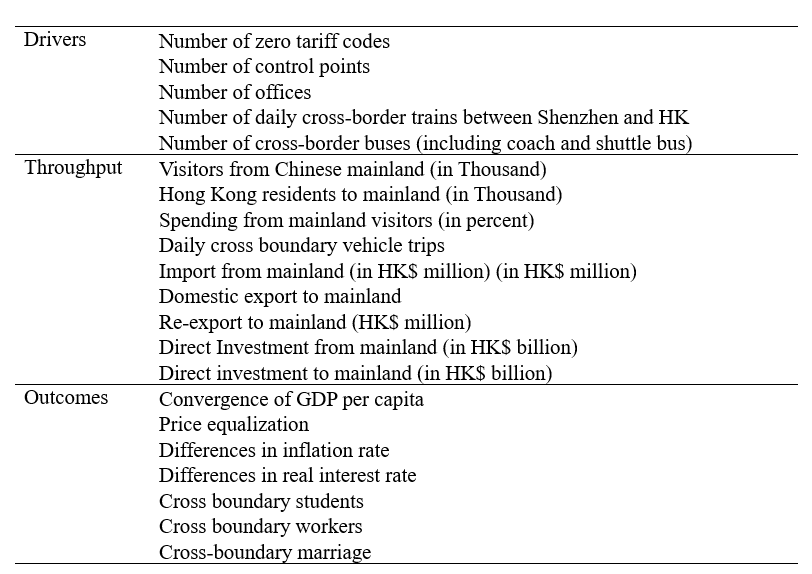

To measure the indicators of each dimension, we retrieved archival data from government sources and international organizations, e.g., Hong Kong Census and Statistics Department (HKCSD), the National Bureau of Statistics of China, and World Bank.

Driving Forces

Factors such as tariff rates and non-tariff barriers may impede economic integration. Economic incentives under the CEPA encourage trade and investment. The drivers of integration include the development of institutional arrangements that reduce the transaction costs of cross-border economic activities. They consist of the number of zero tariff codes signed by both parties, obtained from the Hong Kong Trade and Industry department. We also obtain the number of regional headquarters/regional offices/local offices of mainland firms in Hong Kong.

Time and transportation costs are key factors in economic integration. Studies have found that most joint business activities between Hong Kong and the mainland occur in the Pearl River Delta (Zhang 2005). As such, we use the number of border control points, the number of scheduled cross-boundary trains and buses between Hong Kong and the mainland as proxies for the convenience of transportation. The Hong Kong Immigration and Custom Departments provide information on the control points and the Hong Kong MTR Corporation provides information on the number of scheduled trains between the mainland and Hong Kong. As several cross-border bus companies operate franchise services in Hong Kong (e.g., Eternal East Group and Trans-Island), we include the number of scheduled buses (including coach and shuttle bus) that pass through the control points each day. These data are obtained from the Hong Kong Transport Department.

Throughput Process

The efficient movement of capital, goods and people in the throughput process improves factor allocation. We collect data on the direct investment (both inflow and outflow) between Hong Kong and the mainland in terms of the amount and per cent of external primary income. This measure reflects the repatriation of profits made by foreign firms operating in this area. The major data source is the HKCSD. We also report the net flow of capital (i.e., the difference between the inflow and outflow between Hong Kong and the mainland). Another important transmission channel is the movement of people. We obtain the daily cross-boundary trips between the mainland and Hong Kong. First, we include the number of Hong Kong residents visiting the mainland as reported by the HKCSD. We also include the number of visitors coming from the mainland and the share of spending done by mainland visitors. This information is collected from the Hong Kong Tourism Board.

Outcome Convergence

The effects of the market homogeneity and market symmetry due to economic integration include the synchronisation of economic cycles and the equalisation of consumer prices, wages, interest rates and inflation. First, the economic cycle is measured using GDP, obtained from the World Bank. Second, we measure price levels using the convergence of the Consumer Price Indexes of the Hong Kong (HKCSD) and mainland economies from the World Bank. To identify the convergence of prices and regional GDP per capita, we compute the dispersion using the coefficient of variation (i.e., sigma-convergence). Variables with smaller coefficients of variation are less dispersed than variables with larger coefficients of variation. Furthermore, we collect data on the annual interest rates and inflation rates from the World Bank. We take the absolute differences of the inflation rates and real interest rates between Hong Kong and the mainland and use them as indicators of market homogeneity.

Other outputs of economic integration include indicators of social interactions. Cross-border marriage has become a significant proportion of Hong Kong marriages. The demographic trend in cross-border marriage represents structural changes in families and is a consequence of economic integration. We collect such data from the HKCSD. Another consequence of economic integration is cross-border education. We obtain the data on the number of Hong Kong residents studying in the mainland and the number of mainland residents studying in Hong Kong from the Immigration Department and the Hong Kong Education Bureau.

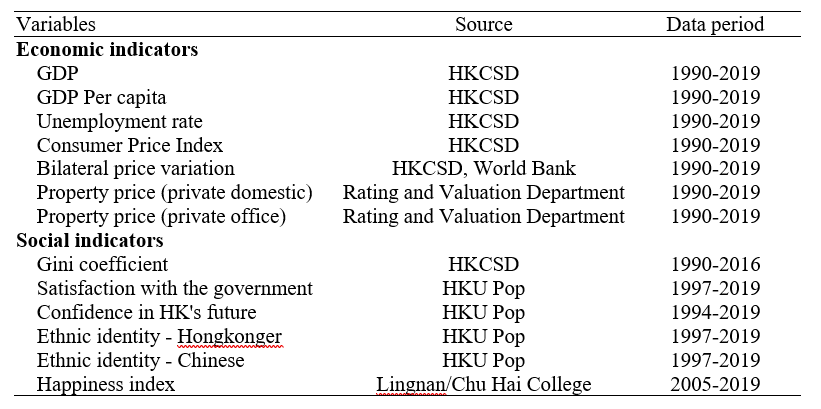

Data Sources

To measure these indicators, we retrieved the relevant data from various sources, including as the Hong Kong Census and Statistics Department (HKCSD), the National Bureau of Statistics of China, and international organisations such as World Bank.

Ling U

Ling U

Ling U

Ling U

Ling U

Methodology

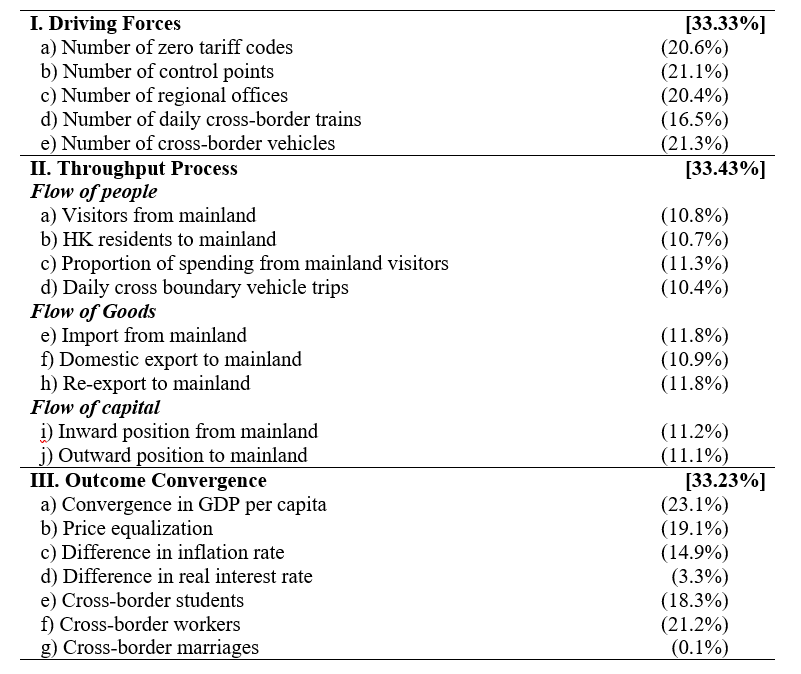

We construct the index using standard statistical methods. After normalising the data using standard methods (distance to a reference), we aggregate the individual indicators. The most popular statistical weighting method is principal component analysis (PCA), which is also used by other indices of economic integration. PCA can identify how different variables change in relation to one another. By transforming the correlated variables into a new set of uncorrelated variables, the relative weights of the indicators can be determined to capture the information common to the individual indicators. We then use different normalisation methods (e.g., z-score) and aggregation methods (e.g., equal weighting) in sensitivity analysis.

To aggregate the data, we first group the indicators measuring the same aspects of integration together to form the sub-indices, from which we construct a composite index. We perform PCA separately for each sub-index, which makes it possible to study the individual aspects of economic integration. The overall index is the combination of the sub-indices.

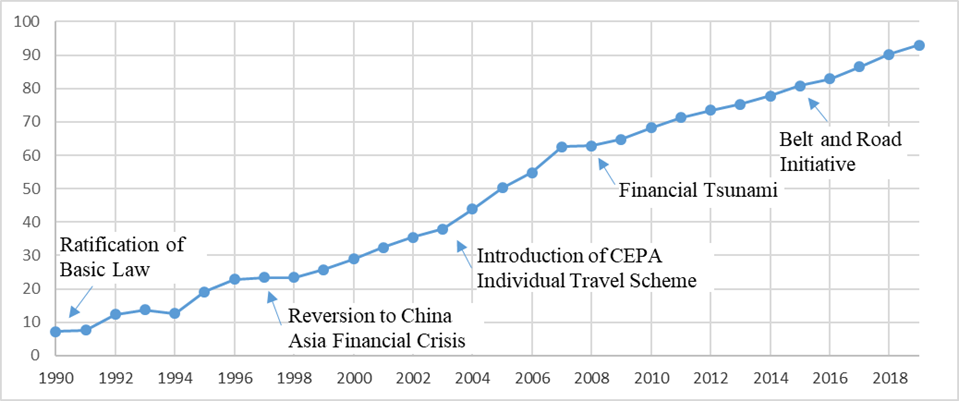

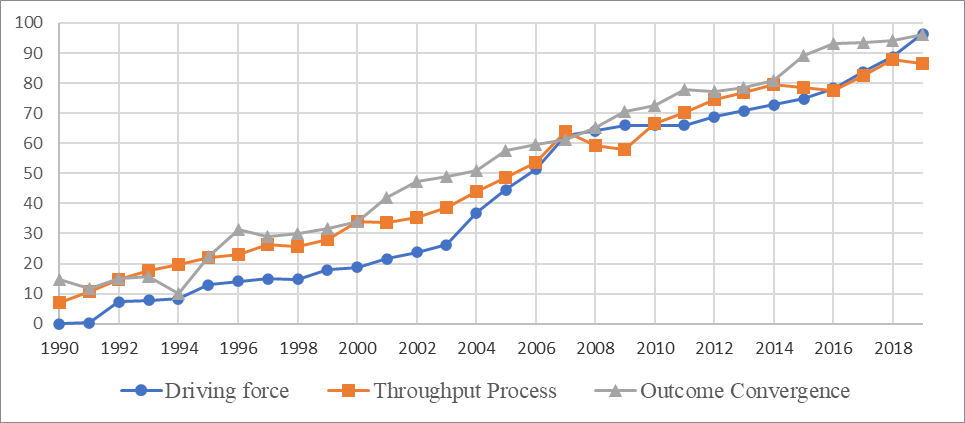

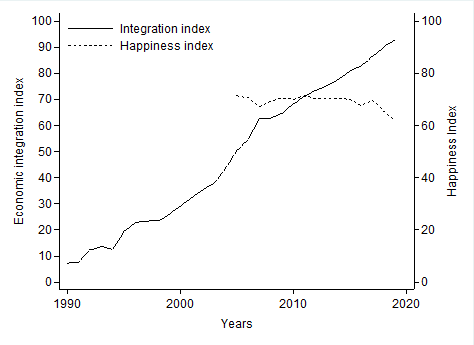

The Economic Integration Index

The overall index of economic integration shows a gradual upward trend (Figure 2). After the Basic Law in Hong Kong was ratified, integration remained at a very low level in the early 1990s. It experienced several years of flat growth until 1997, when Hong Kong was returned to the mainland and the Asian Financial Crisis struck. While the index shows a stable ascension starting in 1999, the overall index picked up speed in 2003, when the first CEPA was signed and the Individual Travel Scheme was introduced. After that, the level of economic integration continued to grow steadily. Starting in 2013, Hong Kong was positioned as a connecting hub in the mainland’s Belt and Road Initiative. The lack of growth during the financial crises of 1994, 1997 and 2008 is also evident. In general, the level of economic integration reached a remarkably high level by the end of the study period, with the components in the three sub-indices explaining 95% of the variance (Figures 2 and 3).

As for the three sub-indices (Figure 2), the throughput process (i.e., the trade and investment activities of both sides) played a vital role in economic integration in the early years. In 2006, the CEPA, as a major driving force, facilitated the closer cooperation of the two economies. Overall, the three sub-indices gradually increased in a linear monotonic trend, approaching a remarkably high level at the end of the observed period. One exception is the decrease in the sub-index of the throughput process between 2007 and 2009 due to the global financial crisis.

Cointegration Analyses

To examine the long-term relationships between the integration index and key socio-economic indicators, we use the VECM to correct the disequilibrium in the cointegration relationships (Table 4). The VECM technique helps distinguish between a long-term and a short-term relationship between two variables. The parameter estimates represent long-term equilibrium relationships in which the disequilibrium error is stationary. The coefficients indicate the average change in the variable in question (e.g., the existing key index) associated with the change in the proposed economic index. In other words, the parameter estimates of the VECM provide the mean rate of change in long-term relationships after controlling for short-term influence and measurement errors.

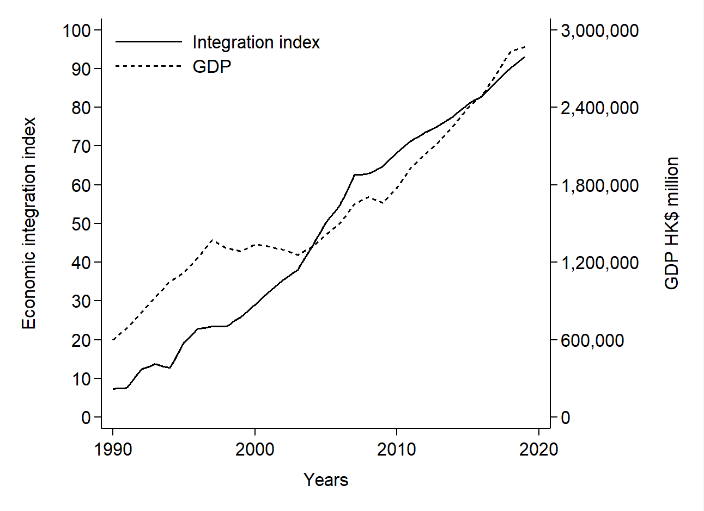

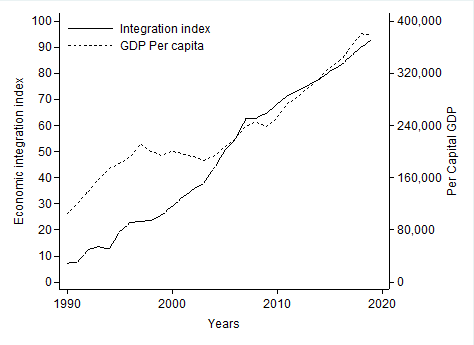

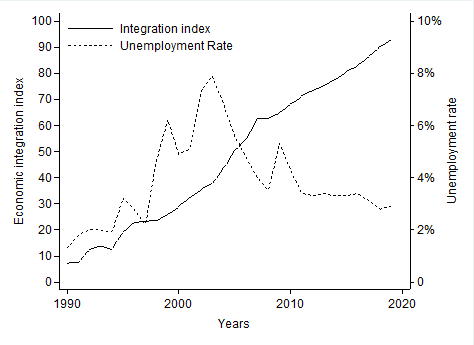

Relationships with Economic Indicators

According to Table 4, the index is positively related to most of the indicators at significance levels of 1%, with the exception of the ethnic identity as a Hongkonger (marginally significant at the 10% level) and happiness index (insignificant). In particular, the integration index is positively associated with GDP growth and GDP per capita. This suggests that economic integration is an important contributor to the territory’s economic development (Table 4 and Figures 4A and 4B). The positive relationship between integration and unemployment also reflects the same pattern (Figure 4C) in the early period. Thus, economic integration promotes efficiency in production, resulting in many labour-intense operations moving from Hong Kong to the mainland. In general, integration weakens the bargaining power of local labour by creating a regional labour pool (Alderson and Nielsen 2002; Brady and Wallace 2000). In the later period, unemployment gradually decreased as Hong Kong transformed itself to a service economy.

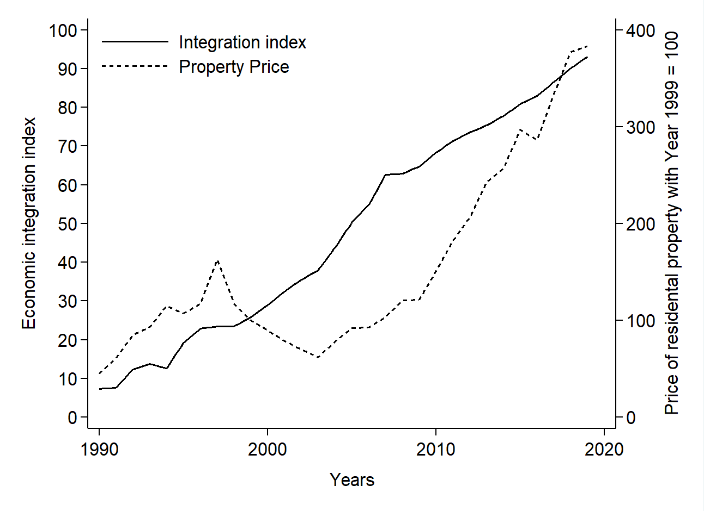

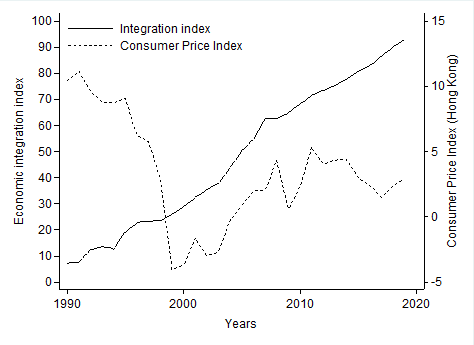

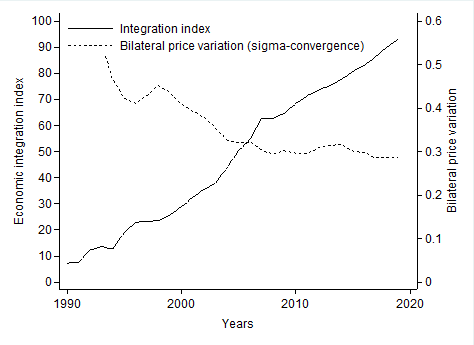

The association between property prices and the economic index reveals a positive relationship (Table 4). As money flows from the mainland to Hong Kong, more venture capitalists diversify their investments by investing in property (both private and commercial property). Aside from the limited supply of land for housing construction, the influx of capital leads to an increase in the prices of residential property (Figure 4D) and a basket of consumer goods and services after 2000 (Figure 4E). In fact, property prices in Hong Kong are among the highest in the world and nearly 20 times the average income in Hong Kong, thus making a home in Hong Kong the least affordable for its people (Demographia 2022). Many consider the exorbitant cost of housing in Hong Kong a major underlying cause of its social ills. As for bilateral price equalisation, the negative relationship between the integration index and the coefficient of price variation (i.e., sigma-convergence) shows a higher level of price convergence between the two economies (Figure 4F).

Relationships with Social Indicators

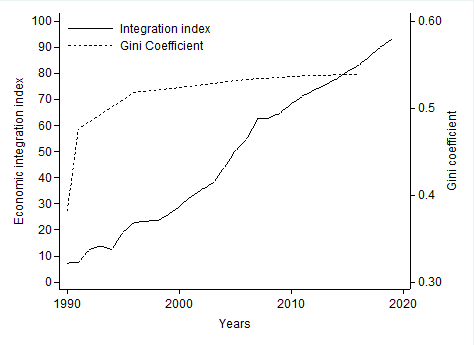

The results also show that increasing economic integration corresponds with greater income inequality and the widening gap between the rich and the poor. Hong Kong’s Gini coefficient has remained higher than 0.50 since 2007, making it one of the worst in the world, especially among the developed economies (Figure 5A). Although the Hong Kong economy has grown at a respectable rate (i.e., 6% per annum in normal times), the real income of average people has not grown at the same pace. Government statistics show that poverty rate in the territory reached a new high in 2019 and put 1.6 million people, 20.4% of the population, under the official poverty line (Hong Kong Business 2019).

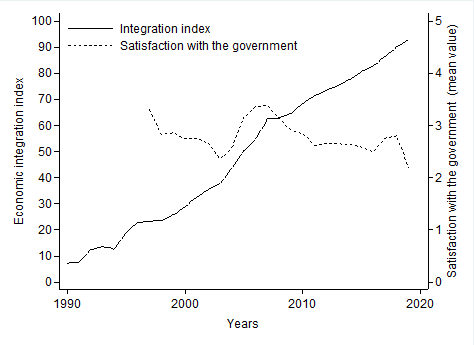

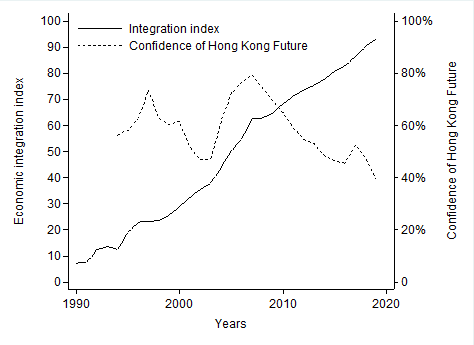

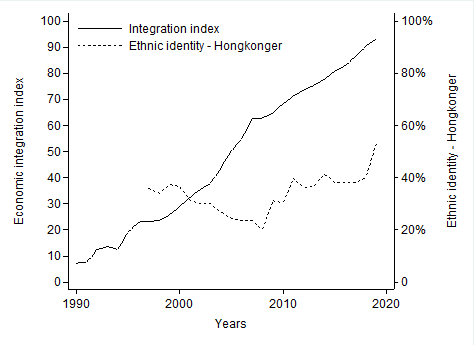

The results also indicated that Hong Kong people were mildly satisfied with the government and perceived the future to be brighter during the early years (Figures 5B and 5C). Although economic integration is positively related to confidence in Hong Kong’s future (Table 4), such confidence has sharply deteriorated (Figure 5C). Not surprisingly, economic integration does not have a significant impact on the happiness of Hong Kong people (Table 4). From 2000 to 2008, ethnic identity as a Hongkonger in comparison to that as Chinese was in a downward trend. However, ethnic identity as a Hongkonger has increased since 2008 (Figure 5D). Thus, continuous integration also promotes a sense of uniqueness among the Hong Kong people. As cross-border travel and communication become more frequent, Hong Kong citizens become more aware of their own identity and developed a stronger sense of uniqueness, especially among the youth (Hong Kong Institute of Asia Pacific Studies 2016).

Major Findings

Economic integration helps eliminate barriers to trade and investment, liberate the factors of production, and encourage efficient resource allocation and production among economic entities. The results suggest that the level of economic integration between Hong Kong and the mainland grew steadily from 1996 to a remarkably high level in 2019. The only exceptions occurred during the Asian Financial Crisis in 1997 and the Financial Tsunami in 2008. Overall, the three separate time series closely follow one another over the study period.

Cointegration analyses indicate that the level of economic integration is associated the continuous economic development of Hong Kong, as reflected in its increasing GDP and GDP per capita over time. Although the unemployment rate increased to its highest level in the early 2000s, it has been on a downward trend in recent years. While consumer price index (i.e., inflation) has remained low since 2000, bilateral price variations significantly decreased over time. Thus, the results indicate an overall positive long-term relationship between the integration index and economic development of Hong Kong.

Cointegration analyses show the non-monotonic trends in the relationships between economic integration and other socio-economic indicators. The level of economic integration is associated with surging real estate prices for both residential and commercial properties, which have recovered from the previous shocks and reached historical highs. Meanwhile, continuous economic integration coincides with increasing economic disparity in the territory, as indicated by the Gini coefficient, one of the highest in the world.

Despite their overall positive relationships with the integration index, other indicators exhibit significant variations over time. While satisfaction with the government and confidence in Hong Kong’s future peaked in 2007, both have since decreased. A surge in ethnic identity as Hongkongers since 2007 is also notable among Hong Kong residents. Interestingly, continuous economic integration has little association with residents’ level of happiness, which shows a slight downward trend.

Overall, these findings provide evidence of the complex relationships between economic integration and other socio-economic indicators as well as public sentiment towards the government and society. While these relationships have been the topics of heated debate, whether economic integration can lead to social cohesion and long-term stability remains unclear (Puig and Chan 2016). Policymakers and researchers may consider these findings in their deliberations when analysing and devising public policies.

Selected References

Alderson, A. S., & Nielsen, F. (2002). Globalization and the Great U-Turn: Income Inequality Trends in 16 Oecd Countries. American Journal of Sociology, 107(5), 1244-1299.

Brady, D., & Wallace, M. (2000). Spatialization, Foreign Direct Investment, and Labor Outcomes in the American States, 1978–1996. Social Forces, 79(1), 67-105.

Hong Kong Business (2019). Poverty Rate Rises to 20.4% in 2019. (accessed 1/3/2020), [available at https://hongkongbusiness.hk/economy/news/poverty-rate-rises-204-in-2019].

Hong Kong Institute of Asia Pacific Studies (2017). Youth Political Participation and Social Media Use in Hong Kong. Research Report, Centre for Youth Studies, The Chinese University of Hong Kong.

Puig, G. V., & Chan, V. (2016). Free Trade as a Force of Political Stability? The Case of Mainland China and Hong Kong. The International Lawyer, 49(3), 299-324.

Zhang, K. H. (2005). Why Does So Much FDI from Hong Kong and Taiwan Go to Mainland China? China Economic Review, 16(3), 293-307.

Ling U

Ling U

Ling U

Ling U

Ling U

About the Authors

For more information, please contact: Geng Cui ([email protected]) and Yuho Chung ([email protected])