Executive Certificate in Sustainable Finance & ESG Analytics

To be announced

This programme aims to enhance students' knowledge about the evolving needs of capital markets concerning ESG & Sustainable Finance. It also provides the foundational knowledge of using contemporary data analytics methods to support Green Financing and ESG analysis for effective ESG integration. The syllabus is aligned with the Certified Environmental, Social, and Governance Analysts (CESGA) examination and accredited by the European Federation of Financial Analysts Societies (EFFAS): https://effas.com/professional-certificates/effas-certified-esg-analyst/.

Upon successful completion of the course, students will be granted the Executive Certificate in Sustainable Finance and ESG Analytics jointly offered by Lingnan University (School of Graduate Studies) and Friend of the Earth. Also, students are eligible to claim for Continuous Professional Development (CPD) hours with their respective professional institution that they are affiliated with.

Maximum HK$10,000 Subsidy

Name of Programme Provider: Lingnan University | Friends of the Earth (HK) Charity Limited

Programme Identification Code: GTP-254234

Programme Name: Executive Certificate in Sustainable Finance and ESG Analytics

This programme is one of the Eligible Programmes under the Pilot Green and Sustainable Finance Capacity Building Support Scheme, (https://greentalent.org.hk/).

Applicants who successfully complete the course can apply to the Pilot Green and Sustainable Finance Capacity Building Support Scheme for reimbursement.

Eligible applicants may apply for reimbursement of relevant fees upon successful completion of Eligible Programmes, subject to a ceiling of HK$10,000 and other conditions.

Application should be sent directly to the Pilot GSF Capacity Building Support Scheme office within three months after programme completion.

For details, please visit the Scheme website: www.greentalent.org.hk,

or contact the Scheme enquiry hotline: 852-2258-6000,

or email to [email protected].

The Pilot Green and Sustainable Finance Capacity Building Support Scheme reserves the final decision-making authority on all matters and disputes.

About the Course

Course Time: 18:30 - 21:30 with 2 breaks

Enrolment: 1 Jun - 31 Jul 2024

Commencement: 1 Aug 2024

Course Schedule

Class Schedule: 2 evening classes per week with 3 hours per class

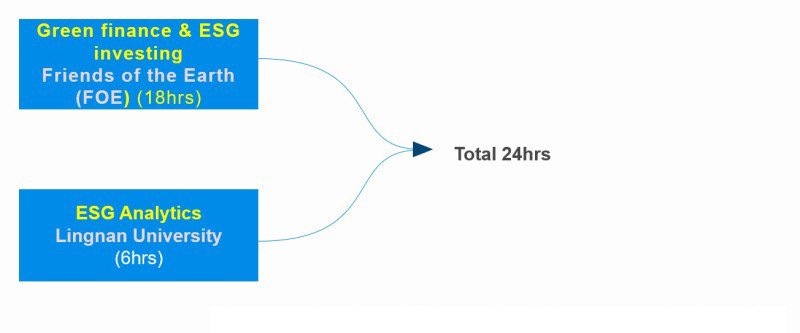

Total Duration: 8 lectures with a total of 24 hours (3 hours per lecture)

Assessment Method

Part A: Individual or group case study to assess understanding of ESG Statistic Analysis, Machine Learning, Risk Analysis Techniques and Big data analytics concepts (50%).

Part B: Assessment of Multiple choice on Green finance & ESC investing (50%).

Completion Requirements: final score is no less than 50 based on the calculation: (Part A+ Part B) /2 (Out of 100 for each part)/2; And class participation and attendance no less than 70%

Course Language

English, Cantonese

Mode of Study

Face to face

Venue

Lingnan Union Park Centre, 771-775 Nathan Road, Prince Edward, Kowloon

Course Structure

Supported by: Pilot Green and Sustainable Finance Capacity Building Support Scheme

Course Syllabus

Lecture-1: Global Trends in Development & Regulatory in ESG & Sustainable Finance

- Trends in ESG Development Around the World

- Market Drivers & Barriers to ESG

- ESG and Financial Performance

- Sustainability Regulatory TrendsImpact of EU Regulations on Corporate

- International Regulatory Trends

- Fundamentals of Green & Sustainable Financing

- Definition of Green & Sustainable Finance

- Common Green Financial Products and Services

- Fundamentals of Green & Sustainable Finance in Banking and Lending

- Principles for Responsible Banking

- Green Banking Products and Services

- International Principles for Green and Sustainable Loan and Bond

Lecture-2: ESG Investing & Responsible Banking

- Green and Sustainable Investing

- Definitions and Developments of ESG Investment

- ESG Investment Strategies

- Green and Sustainable Products and Instruments

- Introduction of Responsible Banking and Lending

- ESG application across Individual Asset Classes

- Sustainable Financing frameworks, instruments and evaluation

Lecture-3: ESG Reporting, Disclosures & Taxonomy

- Global Reporting Standards

- Reporting Frameworks and Disclosure – Voluntary and Mandatory

- TCFD&ISSB

- SASB Materiality Assessment & GRI Sustainability Reporting

- Integrated Reporting, Impact Measurement, and Reporting

- Global Footprint and Carbon Accounting

- Data Source

- Quality

- Coverage

- Limitations & Best Practices

- Concept of Materiality

Lecture-4: Global Sustainable Finance and Carbon Markets Development

- GSF Markets and Trends in HK, the Greater Bay Area and around the World

- Introduction of ESG in Asia Pacific

- Regulatory Framework in Asia

- Country Analysis in Asia Pacific

- Introduction to Global Carbon Markets

- Fundamentals of Carbon Pricing & Trading

- Latest Development of Global Carbon Markets

- Applications for Financial Institutions and Corporates

Lecture-5 ESG Asset Valuation and ESG Fundamental Analysis

- ESG Asset Valuation Basics

- Introduction of ESG Valuation Model

- Basic Valuation Model in Equities, Fixed Income and Infrastructure

- ESG Integration into Fundamental Analysis

- Investment Guidelines

- Research and Asset Allocation

- Corporate Analysis

- Portfolio Management

- Ownership and Engagement

- Performance Attribution & ESG Quality

- ESG Integration

- ESG value Identification

- Analysis of ESG

- Controversies and ESG risk litigations

- Consistency with the Business Model

Lecture-6: ESG Development in Asia Pacific Region & Case Study for ESG Integration

- How Banking and Finance contribute to low-carbon transition to a sustainable economy

- Banking Industry sustainability strategy & practices

- Investment Institutions

- Case Study for ESG Integration

- Practice Case Study

- Case Analysis

Lecture-7: Introduction to ESG and Big Data Analytics

ESG (Environmental, Social, and Governance) bigdata analysis involve the use of advanced statistical methods and tools to analyse and interpret ESG data. These analytic techniques require advanced knowledge and expertise in statistics and data analysis, and can be used to gain deeper insights into a company's ESG performance and its impact on stakeholders.

- Overview of ESG Big Data

- Data Framework

- Importance of Big Data Analysis in ESG Decision making

- ESG Big Data Collection, Method, and Management

- ESG Big Data Collection

- ESG Big Data Quality and Reliability

- ESG Big Data Cleaning, Integration and Valuation Techniques

- ESG Big Data Visualization & Management (For Pattern and Trend Analysis)

ESG Case Studies: Analysis of ESG case studies to illustrate the application of ESG data analytics techniques for risk management and investment decision in real-world situations.

- ESG Website for Data Analytic

- MSCI ESG Research: is a leading provider of ESG ratings, research, and analysis. Information for ESG statistical techniques, including factor analysis, regression analysis, and Monte Carlo simulation.

- S&P Global: it provides a range of financial and ESG data, analytics, and tools.

- CFA Institute: is a global association of investment professionals. It provides resources and information on ESG analysis, use of statistical techniques (factor analysis & machine learning).

-Harvard Business Review: a leading business publication that provides insights and analysis on a range of ESG topics and information on ESG statistical techniques, regression analysis and Monte Carlo simulation.

- ESG Analytic Website URLs:

-SAS

Lecture-8: ESG Statistic Analysis, Machine Learning, Risk Analysis Techniques

ESG statistic analytics, machine learning (ML) involves using data analysis techniques to understand the environmental, social, and governance (ESG) performance of companies, and to draw insights that can inform investment decisions, risk management, and other business strategies. ESG data analytics and ML techniques includes:

ESG Statistical analysis: Can be used to identify relationships and patterns in the ESG data. To identify the relationship between a company's ESG performance and its financial performance.

- Regression analysis: To identify the relationship between a company's ESG performance metrics and financial performance metrics. E.g. Stock price or profitability.

- Factor analysis: to identify & uncover the underlying dimensions of ESG performance, such as environmental impact, social responsibility, and governance practices.

- Cluster analysis: to group companies with similar

- ESG performance metrics together, for example, to identify companies with similar levels of carbon emissions or social impact.

- Scenario analysis: to assess the potential impact of different ESG-related events, such as climate change or social unrest, on a company's financial performance.

- Time-series analysis: to identify long-term trends in ESG performance metrics, such as a company's carbon emissions or diversity metrics.

- Text analysis: To analyses unstructured data, such as news articles or social media posts, to identify patterns and trends. To identify trends in public sentiment towards a company's sustainability practices.

Machine learning: To introduce the machine learning algorithms and models to analyse large and complex ESG datasets and to identify patterns and relationships in data. It is used to predictive of a company's performance in relation to ESG performance.

ESG Risk Management: Introduction to the ESG risk management framework, including risk identification, assessment, mitigation, and monitoring. Overview of ESG data and metrics, including sources of data, types of metrics, and challenges in measuring ESG performance

Investment Decision, Reporting, Trends and Future: The results of ESG data analysis should be integrated with investment decision, including sustainable investing, ESG indices, ESG screening, communicated with stakeholders (investors, customers & employees). Overview of emerging ESG trends and future directions, including the role of technology, social and political developments, and stakeholder expectations.

Course Lecturers

Professional instructors from commerce and business sectors (holder is CESGA and/or CFA)

Prof. Ir. Rosiah Ho, CEng, CPEng, RPEng (Lingnan University)

Dr. WANG Qi Vicky (Research Assistant Professor, School of Graduate Studies, Lingnan University)

Course Fee and Application

Course fee: up to HKD 9,800*

(reimbursable fees under the Pilot Green and Sustainable Finance Capacity Building Support Scheme)

* Full-time student refers to a student studying a full-time course offered by a recognised educational institution as of the date of application.

**Reimbursement amount is dependent on the actual amount incurred by the programme participant and the applicable percentage of reimbursement based on that participant’s applicant category.

^ Need help with the schedule? Please get in touch with us at [email protected] for assistance.

Eligible applicants can apply for reimbursement of fees upon successful completion of Eligible Programmes, subject to a ceiling of HK$10,000 (conditions apply). Refer to the scheme website for details.

Eligible applicants can apply for reimbursement of fees upon successful completion of Eligible Programmes, subject to a ceiling of HK$10,000 (conditions apply). Refer to the scheme website for details.

The Scheme provides training subsidies to Hong Kong residents who are market practitioners and prospective practitioners of green and sustainable finance, namely students and graduates in relevant disciplines. After completing Eligible Programmes, applicants can apply for a subsidy of up to 80% of the relevant fees (full-time student applicants can apply for a subsidy of up to 100% of the relevant fees), subject to a ceiling of HK$10,000.

The reimbursement application should be submitted via the application portal of the Scheme (https://www.greentalent.org.hk/auth/login) within 3 months from the date of completion of the Eligible Programme.

Programme Name | Programme Identification Code | Effective Date Under the Scheme* |

Executive Certificate in Sustainable Finance & ESG Analytics | GTP-254234 | 2024/03/05 |

Application Method

Click here

Certificate

Enquiries:

e-mail: [email protected]

If you need to contact the programme administrator, please click here.